Trading Type in Indian Stock Market: Friends, there are many different types of trading in the Indian stock market, and each has its objective and risk. All the investors investing in the stock market choose different trading methods according to their requirements. These include Optional Trading, Intraday Trading, Positional Trading, Swing Trading, Momentum Trading and Long Term Trading. Today, with the help of this article, we are going to give you detailed information about all the different types of trading so that you can develop a strategy for your investment goals and risk-taking.

Trading Type in Indian Stock Market

The share market is where most of the citizens of India are active today, but they do not have information about how many types of trading can be there. You do not need to worry because, in today’s article, we have shared information about the top six trading types of the Indian share market.

Any new investor needs to understand the foundation of the stock market before investing their money, so in today’s article, we will give you information about the types of trading, which is very important for all new investors to know.

Optional Trading

Options trading can be a risky trading option because the investor has to pay a premium amount, and this premium is not returned. Options trading is used to earn profits in short form. To use option trading, you need to know and understand the market. There are two main types of option trading.

- Call Option: Call option gives the person investing in the stock market the right to buy shares at a specified price in the future.

- Put Option: The put option works to sell shares at any specified time in investing in the stock market.

Intraday Trading

Intraday trading means that you buy and sell shares in a single day. In intraday trading, you can buy and sell shares from 9:15 am to 3:30 pm. You have to do this before the market closes. Intraday trading is for all those active in the stock market daily and trade by closely observing all the market activities.

- While doing intraday trading, you need to make quick decisions.

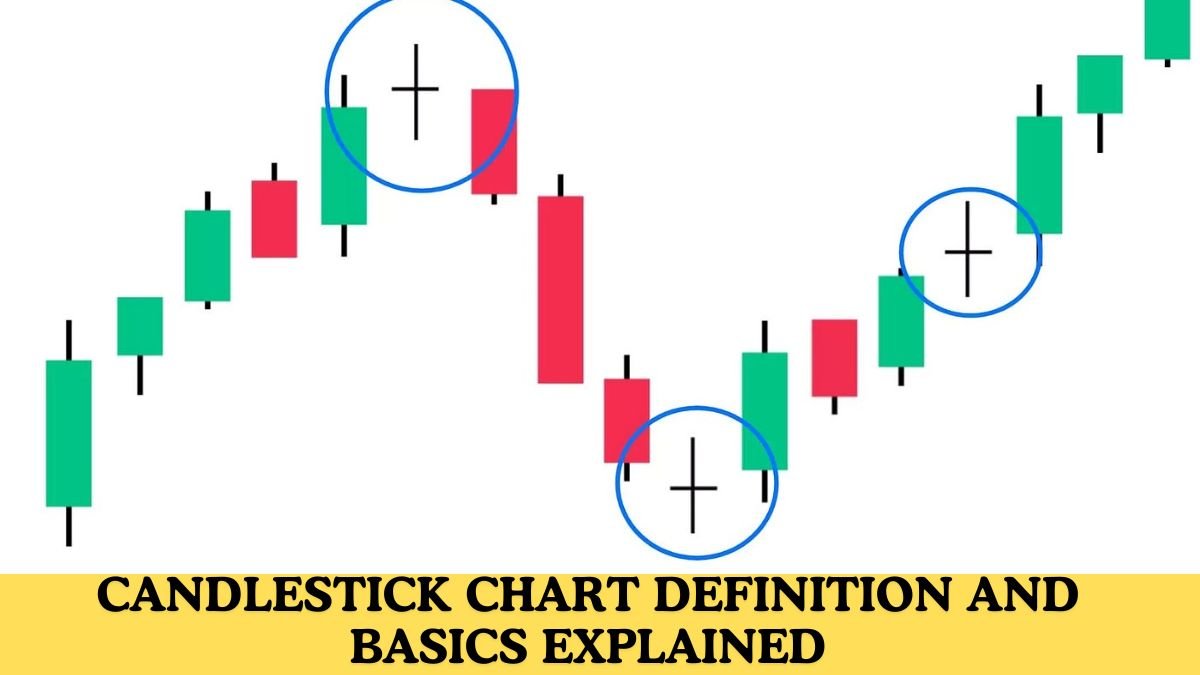

- To do intraday trading, you need technical analysis such as charts, indicators, market movement, looking at market details of different stocks, etc.

- The risk in intraday trading is also very high because any stock price can change at any time.

- Intraday trading is also known as day trading.

If you want to succeed in intraday trading, you need to keep an eye on the market’s technical indicators, chart patterns, and price action.

Long-Term Trading

Long-term trading is mainly in which all the investors investing in the stock market get the right to hold any stock for a long time (usually for many years). All the investors investing in the long term invest by trusting the strong fundamental position of any company. Long-term trading requires patience and a long-term view. If you invest in long-term trading by devising a strategy that fits your needs, then you can get benefits for a long time.

Benefits of Long Term Trading

- In long-term trading, the chances of loss due to small fluctuations in the market are meagre.

- With the help of long-term trading, you can invest in any company and increase your wealth and the company’s growth.

- In long-term trading, all investors also get the benefit of compounding interest.

Positional Trading

While doing position trading, the investor must look at two points: entry and exit. In this, the trader has to analyze the price of the stock to determine when to buy it and at what point to sell it. This comes in short-term profit trading.

Swing Trading

Swing trading is considered a challenging type of trading for all traders in which one has to continuously monitor the ups and downs of the stock for 5, 10 minutes to 24 hours. If the trader learns this type of trading, he can make accurate predictions of trading, so this trading is considered the best strategy.

Momentum Trading

This is the most accessible and most commonly adopted trade in the stock market in which the trader has to predict the right time to enter or exit the stock as per the strategy. In this trade, the trader exits the stock when there is a possibility of the stock falling and buys the stock when the price of the stock is very low.

Conclusion

We have provided information about all the trading types of the Indian stock market in this article above. Apart from this, Indian traders also use trading types, but we have told you six important types above, the easiest and most used of which is momentum trading. If you do not find any of the information above correct, you can tell us in the comment box.

Optional trading is used to earn profit in short form. To use Optional Trading, you need knowledge and understanding of the market.

Intraday trading means that you buy and sell shares in a single day. In intraday trading, you can buy and sell shares from 9:15 am to 3:30 pm. You have to do this before the market band. Intraday trading is for all those active in the stock market daily.

Long-term trading is mainly in which all the investors investing in the stock market get the right to hold any stock for a long time (usually several years). All the investors investing in the long term invest by trusting the strong fundamental position of any company.

My name is Chirag Suthar, and I have been blogging for the last five years. Every day, I share the latest articles on my blog with all my users. On Groww Stock, I will provide you with all the information related to finance.

1 thought on “Trading Type in Indian Stock Market (Optional, Intraday, Long Term etc.)”